Brexit is fast-approaching so make sure you’re ready

It is highly likely that your business, family and personal circumstances will be affected in some way. We recommend using this helpful Brexit checker to get a personalised list of actions:

The following are the essentials that your organisation needs to think about and complete by the 31st December 2020, in order to keep cross-border trading going and to avoid extra tax costs as well as frustrated customers:

VAT checklist

- Will you need extra VAT registrations to continue selling?

To avoid major tax fines, most UK and EU sellers will have to apply for additional VAT numbers to continue selling after the 31st December 2020 – the end of the Brexit transition period. They will lose one of their most important VAT simplifications for cross-border selling – distance selling thresholds. - Will you have to appoint multiple EU Fiscal Representatives?

The UK is scheduled to leave the EU VAT regime on the 31st December 2020 when the Brexit transition period ends. If you are a UK business with a foreign VAT registration in the EU27 for your local trading, you will probably have to appoint a Fiscal Representative. If you fail to appoint one, your VAT registration will be blocked, and you will not be able to file or pay taxes which will incur automatic heavy fines. You will also probably have your goods blocked, and counter parties are likely to refuse to trade without a correct VAT status. - Can you avoid the import VAT trap?

After the 31st December 2020, ecommerce businesses selling goods to consumers between the UK and EU will face import VAT bills – or give their customers an unpleasant extra charge to get their goods from the delivery agent. It is important to understand how this is payable, if it can be eliminated, to avoid customers going elsewhere. Why is import VAT now due on ecommerce UK and EU selling? The UK leaves the EU VAT regime at the end of its Brexit Transition Period – 31 December 2020. When seller send their goods to a UK or EU customer, someone has to pay import VAT for the first time. You can leave it to your customer, and not tie yourself up in the bother of declaring or try to recover any of it. But this will result in a poor experience for your customer, including an extra charge and delayed delivery. This will probably mean no repeat business. - Will you need a new VAT registration to continue selling digital services?

If you are an EU or UK seller of digital services, then you will need new VAT registrations to avoid being fined by the tax authorities. This includes cross border sales to UK and EU consumers of: downloadable or streaming media; apps; online software; e-learning; e-books; online journals; and dating or similar membership websites.

Customs checklist

- Have you got UK and EU EORI numbers to clear goods?

If you are selling goods to consumers between the UK and EU after 31 December 2020, you are going to need EORI numbers. If you don’t have these, your goods will be held by customs in the UK or EU, resulting in lost sales and extra costs to get them back. - Ready to complete customs declarations?

Any UK or EU ecommerce sellers selling goods between the UK and EU will have to compete customs declarations for the first time after 31 December 2020. This follows the UK leaving the EU Customs Regime at this time following the UK’s Brexit. Failure to do so will mean your freight or postal agent will refuse to accept the goods, as customs would not accept them either. You will also have to think about how to classify your goods and what tariffs or VAT is payable – see elsewhere in this guide. - How will you pick the right commodity code?

If you want to continue selling goods cross-border between the UK and EU after 31 December 2020, you will have to learn about commodity codes. If you cannot accurately match your goods to the right code, you will be paying the wrong duties – risking top-up taxes and fines – and delaying deliveries to frustrated customers. The UK is still formulating its post-EU commodity code schema – so this area is confusing. The commodity codes will have to be included in the customs declaration that you will need to provide to clear any goods through UK or EU customs. This will make clear how much taxes – VAT and tariffs – you should be paying - Confident you will pay the right import tariffs?

With UK leaving the EU Customs regime at the end of 2020, many imported goods will be subject to UK and EU tariffs, respectively. Here are the many challenges of getting it right, and fairly quoting your customers the entire cost of purchase – the landed cost.

How can my ERP system help to make the transition?

Dynamics Business Central

Item Charges

To ensure correct valuation, your inventory items must carry any added costs, such as freight, physical handling, insurance, and transportation that you incur when purchasing or selling the items. For purchases, the landed cost of a purchased item consists of the vendor’s purchase price and all additional direct item charges that can be assigned to individual receipts or return shipments. For sales, knowing the cost of shipping sold items can be as vital to your company as knowing the landed cost of purchased items.

In addition to recording the added cost in you inventory value, you can use the Item Charges feature for the following:

- Identify the landed cost of an item for making more accurate decisions on how to optimise the distribution network.

- Break down the unit cost or unit price of an item for analysis purposes.

- Include purchase allowances into the unit cost and sales allowances into the unit price

Before you can assign item charges, you must set up item charge numbers for the different types of item charges, including to which G/L accounts costs related to sales, purchases, and inventory adjustments are posted to. An item charge number contains a combination of general product posting group, tax group code, VAT product posting group, and item charge. When you enter the item charge number on a purchase or sales document, the relevant G/L account is retrieved based on the setup of the item charge number and the information on the document.

For both purchase and sales documents, you can assign an item charge in two ways:

- On the document where the items that the item charge relates to are listed. This you typically do for documents that are not yet fully posted.

- On a separate invoice by linking the item charge to a posted receipt or shipment where the items that the item charge relate to are listed.

Note

You can assign item charges to orders, invoices, and credit memos, for both sales and purchases.

Dynamics GP

Landed Costs

Use the Landed Cost Group Maintenance window to create a group or collection of landed cost records. By creating groups of landed costs, you can assign several landed costs to an item at once.

Once you’ve created landed cost records, you can create landed cost groups. A landed cost group is simply a collection of several landed cost records. Each landed cost record can exist in multiple landed cost groups. Each landed cost group can include as many landed cost records as you like. By creating a landed cost group and assigning it to item-site combinations, you can associate many different landed cost records with an item-site combination. When the item-site combination is entered on a purchase order, the landed cost group information automatically is reflected in the transaction.

Use the Landed Cost Maintenance window to create a landed cost record—a combination of vendor, currency, and rate type that are used to calculate the costs of getting items—especially items purchased from a foreign vendor—from the vendor to your business. For each landed cost record, you can select a vendor, currency and rate type. You can determine how the landed cost is calculated and can select the accounts to be updated when items with landed costs are received.

Use the Landed Cost Maintenance window to define a landed cost record. Each landed cost record can be tied to a specific vendor, but you can change the vendor when you use the information for a transaction. You can create as many landed cost records as you like.

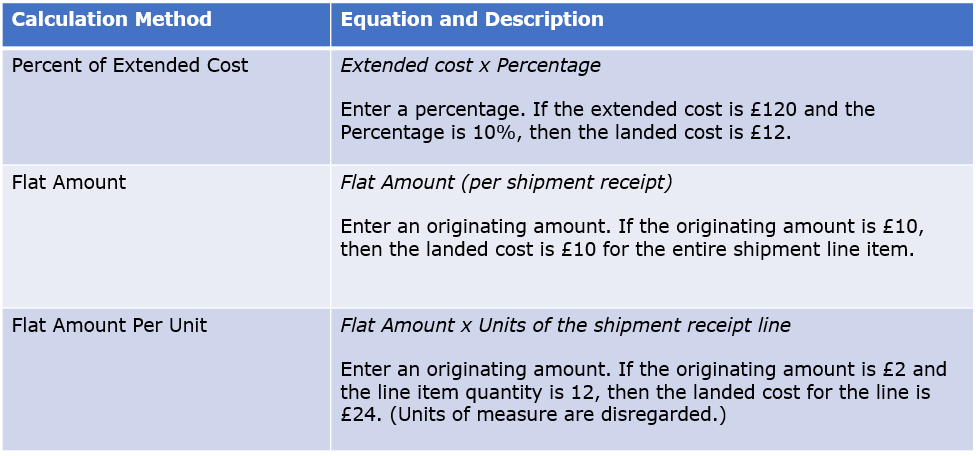

Cost calculation methods for landed costs

Three methods are available for calculating landed costs. Refer to the table for more information.