Guidance on the temporary reduced rate of VAT for hospitality, holiday accommodation and attractions

On the 8th July 2020, as a measure to support certain sectors in their recovery following the COVID-19 lockdown, the UK Government announced changes in the VAT treatment of certain supplies of hospitality, hotel and holiday accommodation and admission to certain attractions, which took effect from the 15th July 2020.

The VAT rate reduction applies to organisations which make supplies of hospitality, hotel and holiday accommodation and admission to certain attractions, and their advisers. The following supplies will benefit from the temporary 5% reduced rate of VAT:

- Food and non-alcoholic beverages sold for on-premises consumption, for example, in restaurants, cafes and pubs

- Hot takeaway food and hot takeaway non-alcoholic beverages

- Sleeping accommodation in hotels or similar establishments, holiday

- accommodation, pitch fees for caravans and tents, and associated facilities

- Admissions to the following attractions that are not already eligible for the cultural VAT exemption such as:

Theatres

Circuses

Fairs

Amusement parks

Concerts

Museums

Zoos

Cinemas

Exhibitions

Similar cultural events and facilities

Where admission to these attractions is covered by the existing cultural exemption, the exemption will take precedence.

If your business is included in the list above and you use Microsoft Dynamics 365 Business Central within your organisation to manage your financial information, here’s a step-by-step guide to how to adjust your system to the new VAT rate.

Tax Changes in Dynamics 365 Business Central

Note: Most of the VAT settings can be accessed via General Ledger Settings > VAT, or you can use the standard Lookup from the toolbar header and search the window name.

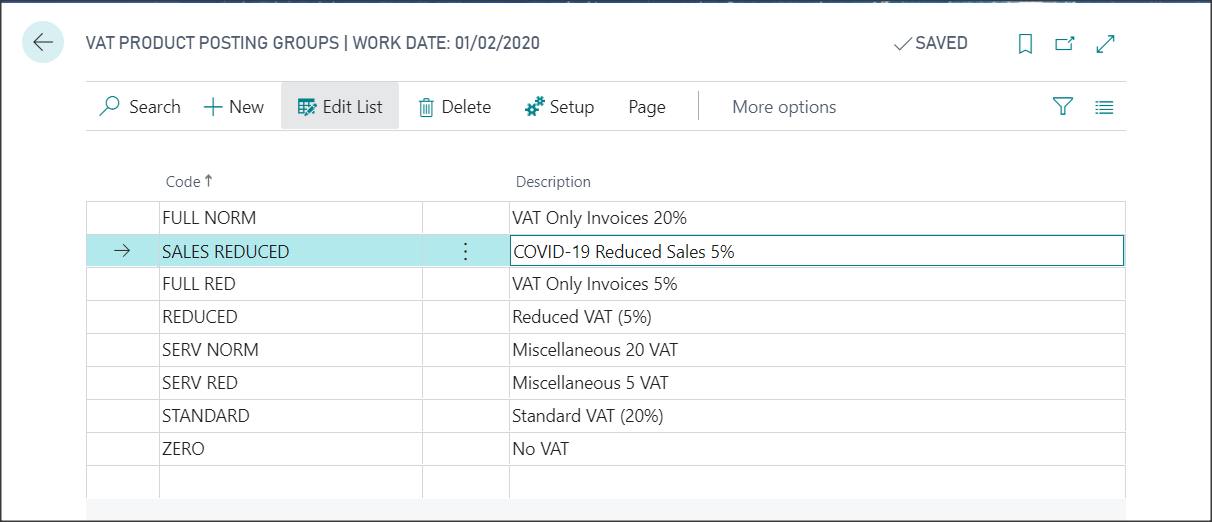

VAT Product Posting Group

Review your existing VAT Product Posting Groups to see whether a REDUCED posting group already exists. If this is the case, you could use this for both Sales and Purchase transactions or create a new one for ease of enquiry.

Go to VAT Product Posting Group window.

Click New and create a new Code and Description.

VAT Posting Setup

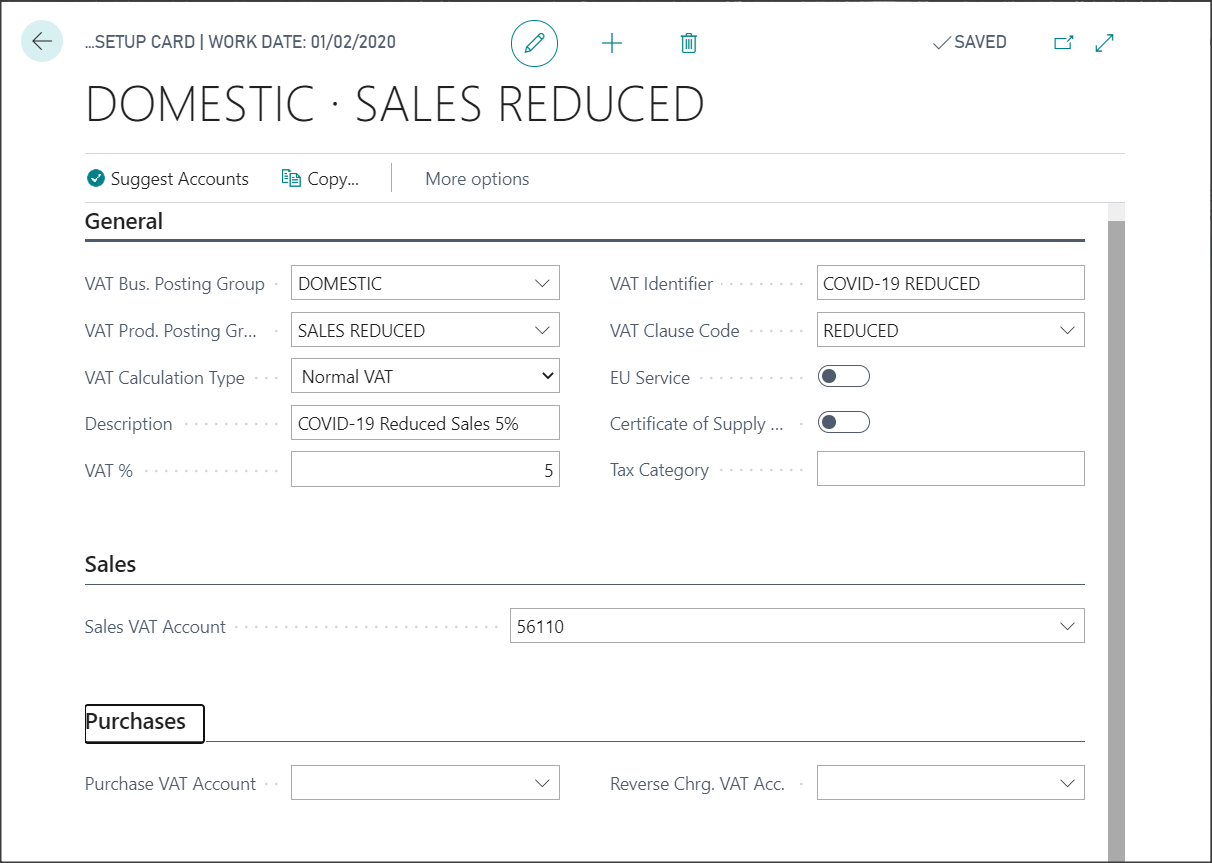

Create a new link between your existing VAT Business Posting Group and the new VAT Product Posting Group.

Go to VAT Posting Setup window. Click New to open the VAT Posting Setup Card.

Select your VAT Business Posting Group

Select your VAT Product Posting Group

Set VAT Calculation Type = Normal VAT

Enter a Description

Set the VAT % to 5

Enter a VAT Identifier

Select VAT Clause Code = REDUCED

Select your Sales VAT Account

VAT Reporting

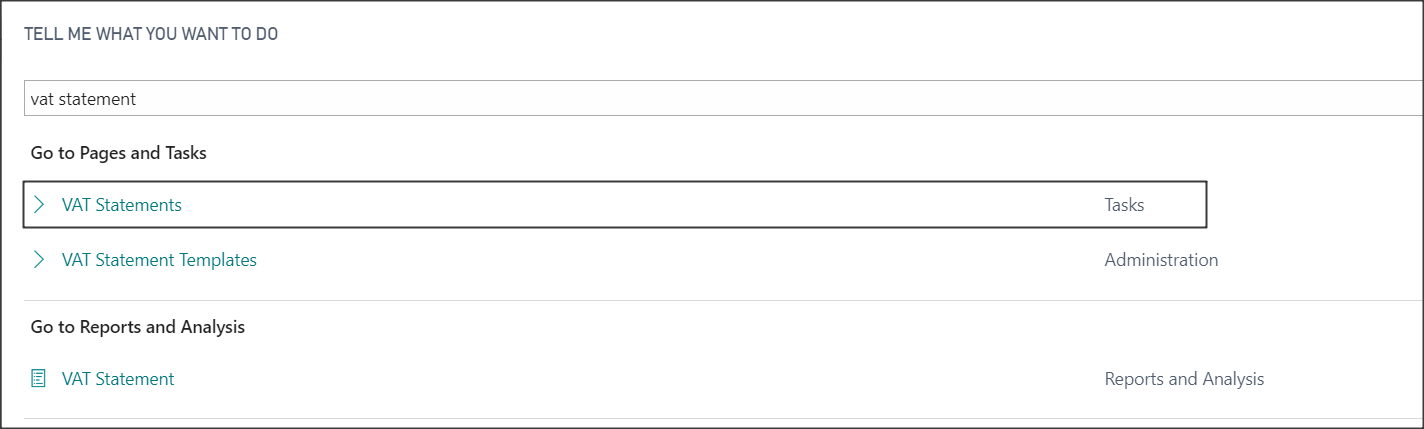

You now need to update your VAT statement to include the new VAT rate.

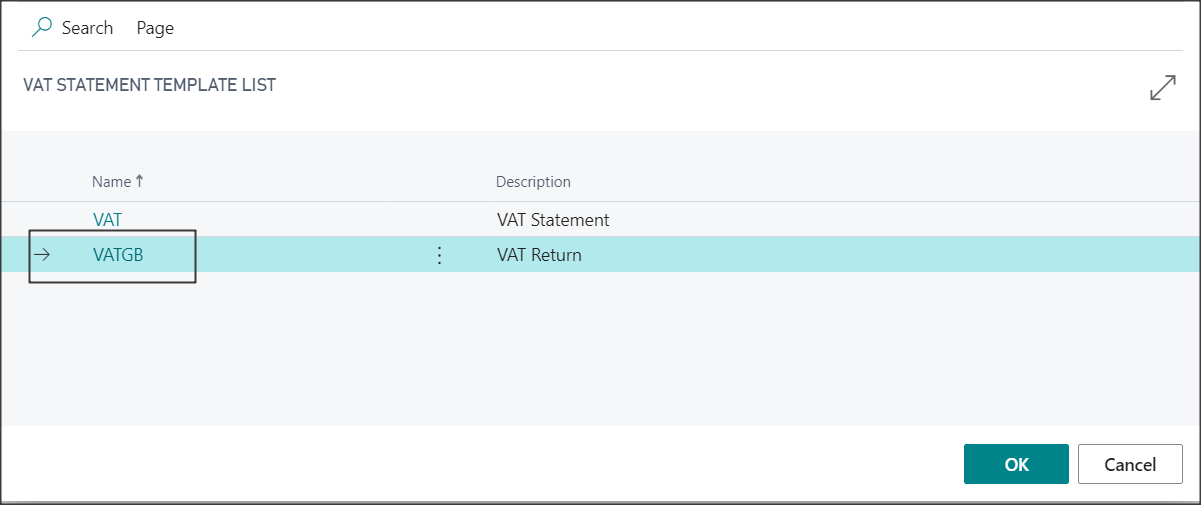

Use the lookup and search for VAT Statements. Select the VAT Statements Task option, then click the GBVAT template link.

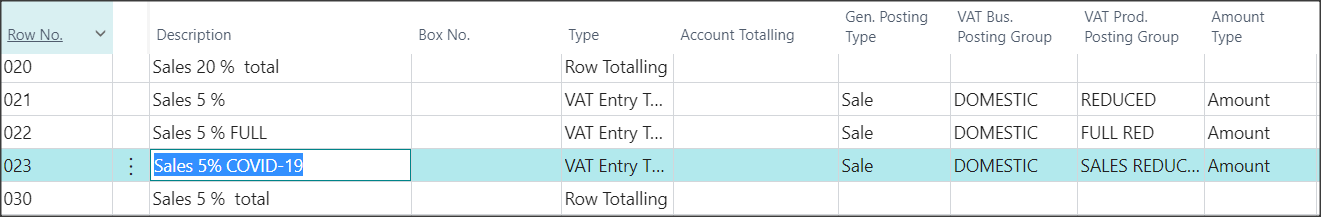

This will open up the report template showing row information for your Summary VAT report, boxes 1 to 9, and then each VAT posting description. We need to add new lines for the new Reduced VAT code and then make sure the Row Totalling includes them. Note the Column headings.

Scroll down to the rows just below your box 1 to 9 entries to find your Sales Tax entries.

Insert a row between the existing codes and the Totalling row by clicking the ellipsis and selecting New Line

In column Row No. enter a row number, (between the existing and totalling row).

In Description enter a Description

Leave Box No.

Set Type to VAT Entry Totalling

Leave Account Totalling

Set Gen Posting Type to Sale

Select your VAT Business Posting Group

Select your VAT Product Posting Group

Set Amount Type to Amount

Leave Row Totalling

Set Calculate to Opposite Sign

Leave the Print option un-ticked

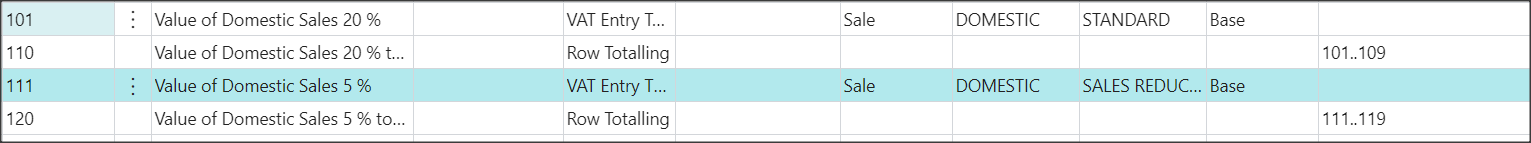

Scroll down again until you find your Value of…. Sales Entries.

Insert a row between the existing codes and the Totalling row by clicking the ellipsis and selecting New Line.

In Row No. enter a row number, (between the existing and totalling row).

In Description enter a Description

Leave Box No.

Set Type to VAT Entry Totalling

Leave Account Totalling

Set Gen Posting Type to Sale

Select your VAT Business Posting Group

Select your VAT Product Posting Group

Set Amount Type to Base

Leave Row Totalling

Set Calculate to Sign

Leave the Print option un-ticked

Close out of all windows.

Sales Order Processing

Review your existing Sales Orders and unposted Sales Invoices dated from the 15th July 2020 onwards and change the tax on the order to the new rate where applicable.

If you have any questions regarding making the VAT rate adjustment within your Dynamics 365 Business Central solution, contact our team today and we’d be delighted to support you. Alternatively, we are hosting a webinar on Thursday 30th July where our ERP Consultant will guide you through the process – simply click here to register.